Stop Loss Strategies for Options Traders

Featured image: Stop Loss Strategies for Options Traders

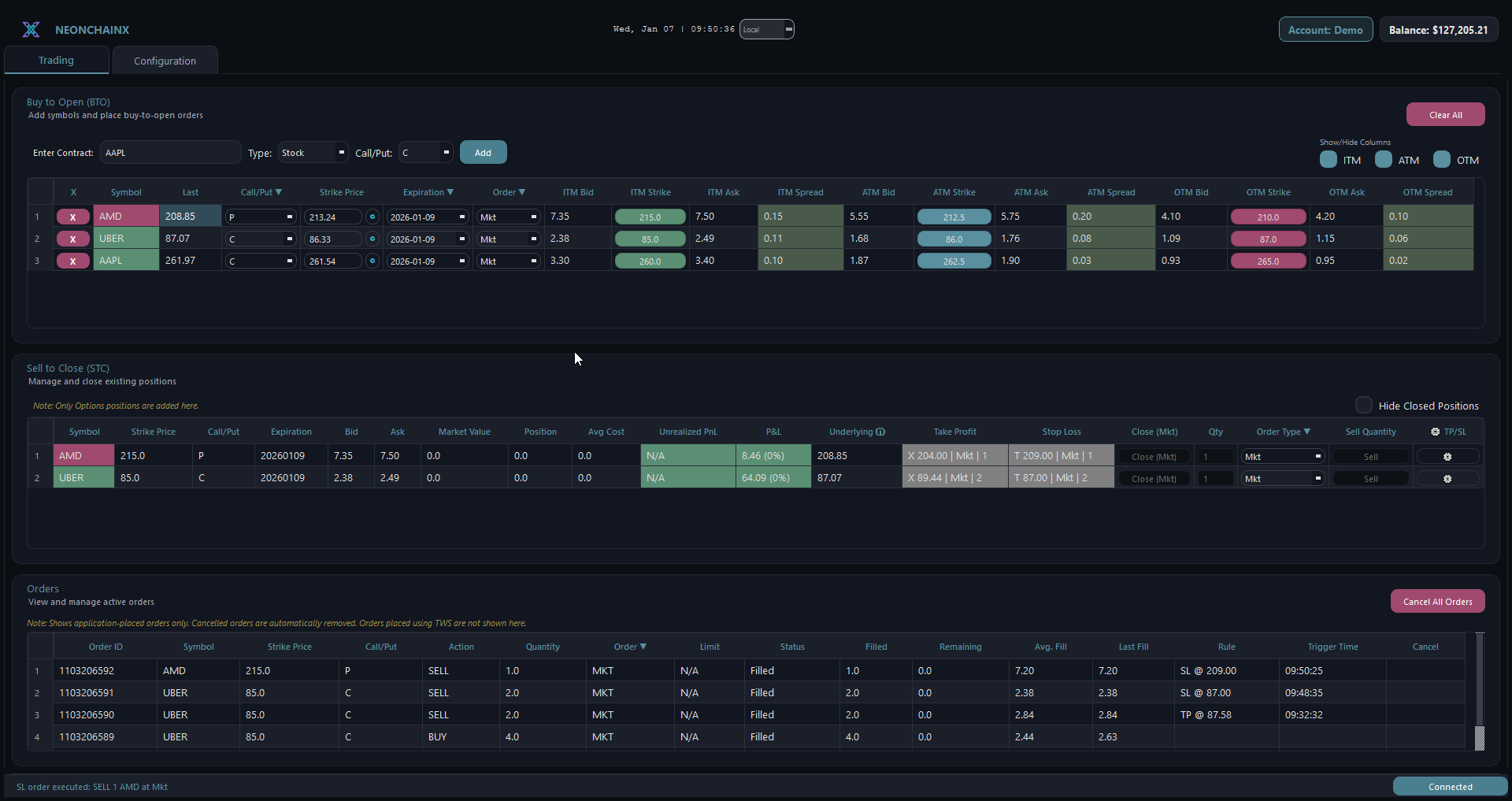

Stop losses are simple for stocks and complex for options. Premium responds to price, volatility, time, interest rates, and dividends, so a basic percent stop can cut winners and cement losses. This guide distills practical stop loss strategies for options traders, with position-specific playbooks, execution tips that reduce slippage, and a repeatable plan you can automate. Where useful, we note how NeonChainX helps you apply these ideas with one-click TP or SL automation and rule-based order triggers.

Why stop losses are different with options

Options are nonlinear instruments, which means the same underlying move can produce very different outcomes depending on time to expiry, strike selection, and the volatility regime. Three realities matter for stops:

- Liquidity and spreads vary by strike and expiry, so market stops can slip.

- Greeks shift through time, especially near expiration where gamma accelerates moves and IV swings can move premium even if price is flat.

- Multi-leg positions create path dependency, so you often want a position-level stop, not a leg-level stop.

Authoritative primers from exchanges like Cboe Education and the Options Industry Council explain how volatility, time decay, and assignment risk interact. Your stop approach should reflect these forces, not only the underlying price.

Core stop loss frameworks for options

Below are the most used frameworks. Many traders blend two, for example a time stop plus a premium-based stop.

1) Premium-based stops

Close when option or position debit increases to a level that invalidates your risk budget. For long options, that might be 40 to 60 percent of the premium paid. For short premium, many use a multiple of the initial credit, such as 1.5 to 2 times the credit received.

Pros: Simple, position aware. Cons: Can trigger on IV noise without a real change in thesis.

2) Underlying price stops

Exit when the underlying touches a level that breaks your thesis, for example a prior swing low for long calls, or a breach of the short strike for a credit spread.

Pros: Aligns to trade idea. Cons: May not account for IV changes, and options can gap beyond a level.

3) Delta or Greeks-based stops

Exit when the short strike delta of a spread hits a threshold, for example 0.25 to 0.35 on iron condors, or when the long option delta falls under a floor that implies the thesis is unlikely.

Pros: Adaptive to time and IV. Cons: Requires monitoring and reliable data.

4) Volatility or ATR-based stops

Use a multiple of Average True Range on the underlying, or require that IV percentile remain inside a band. Popular for short premium and range trades.

Pros: Filters noise in choppy regimes. Cons: Can lag in fast markets.

5) Time-based stops

Pre-decide to exit by a fixed number of days to expiration, or before known events like earnings to avoid IV crush or assignment risk. Common thresholds include 21 days to expiration for monthly cycle trades or exiting long options 2 to 3 sessions before earnings if the thesis is pre-earnings drift.

Pros: Controls theta bleed and event risk. Cons: You may exit before the move completes.

6) Trailing stops on premium

Lock in gains by trailing the option or position price by a set percent or dollar amount. Works best in trends and when liquidity is adequate.

Pros: Lets winners run. Cons: Can be whipsawed in mean-reverting markets with wide spreads.

Matching stop type to strategy

Use the table to map common strategies to practical stop choices. Ranges are typical starting points, not prescriptions.

| Strategy | What to watch | Common stop idea | Why it works | Watch-outs |

|---|---|---|---|---|

| Long call or put | Option debit, underlying levels, time | Premium stop at 40–60 percent loss, or underlying breaks thesis level, plus time stop before key events | Protects capital from theta and IV shocks | Wide spreads near expiry, overnight gaps |

| Debit vertical | Net debit, break-even, underlying trend | Exit if 40–60 percent of debit is lost, or if underlying invalidates spread direction | Caps downside, preserves remaining extrinsic | Max value limited, do not chase fills |

| Short put or call credit spread | Net debit to close, short strike delta, underlying touch of short strike | Stop at 1.5–2.0 times credit, or when short strike delta > 0.30, or price closes beyond short strike by 0.5 ATR | Controls tail risk while allowing time decay | Assignment risk, gap risk into stops |

| Iron condor | Combined debit to close, short strike delta, price relative to wings | Close at 1.5–2.0 times credit or when one side short strike delta > 0.30, consider time stop around 21 DTE | Manages one-sided breaks early | IV expansion can inflate losses without a breach |

| Calendar or diagonal | Net debit, IV regime, underlying around anchor strike | Exit if 25–40 percent debit loss or if underlying moves beyond effective tent, avoid event IV crush if long near-term | Reflects vol and time structure | Slippage across expiries |

| Straddle or strangle | Net debit/credit, realized vs implied volatility, price breakout | Exit if realized vol underperforms for set days, or stop if loss hits 20–40 percent of max plan, trail winners on breakouts | Ties stop to the vol thesis | Fast moves near expiry are gamma sensitive |

| Covered call | Stock risk and ex-dividend dates | Use stock-based stops for downside, manage short call by rolling or closing before ex-div if assignment is undesirable | Separates stock risk from option income | Early assignment around dividends |

Execution tactics that reduce slippage

- Prefer stop limit or rule-based triggers over pure market stops on thin options. A stop that converts to a limit can cap slippage but may not fill in a gap, so size and urgency matter.

- Reference the correct side. For a sell to close on a long option, monitor the bid, not the mid, if you need certainty of trigger. For a buy to close on a short, monitor the ask. If you want fewer false triggers, use mid-based logic with a tolerance.

- Avoid illiquid strikes and very near-expiry contracts where spreads are wide and gamma is extreme unless the strategy requires it.

- Be aware of trading hours. Many options do not trade pre-market or after hours. Stops will not trigger until the session opens, which introduces gap risk.

- For multi-leg positions, prefer position-level exits, not leg-by-leg liquidation, to avoid breaking the hedge during a fast move.

NeonChainX helps you implement these mechanics with one-click TP or SL automation, rule-based order triggers, and order price controls like bid, ask, or mid selection. For setup specifics, see the platform guide on Take Profit and Stop Loss configuration.

Strategy playbooks, with examples

Long call before earnings drift

- Thesis: Pre-earnings drift higher, exit before the report to avoid IV crush.

- Plan: Time stop 1 to 2 sessions before earnings, premium stop at 50 percent loss, and a trailing stop at 25 percent giveback once the option is up 60 percent.

- Example: Pay 2.00 for a call. Stop at 1.00, trail once price reaches 3.20 using a 0.80 trail, and close at the time stop if neither hit.

Short put credit spread on a rising stock

- Thesis: Stock remains above support and time decay works in your favor.

- Plan: Credit 1.00 on a 5-wide spread. Stop at 2.00 debit to close, or if price closes below the short strike, whichever comes first. Consider a time stop around 21 DTE.

- Why: The 2x credit reflects a common risk cap while allowing normal retests and decay to play out.

Iron condor in a range

- Thesis: Price stays within expected move, IV mean reverts.

- Plan: Credit 1.50. If either short strike delta exceeds 0.30 or net debit to close reaches 3.00, exit. If price approaches one side, reduce risk by buying an extra long wing or closing the threatened side early.

- Note: IV expansion can move the debit without a breach. If the thesis is intact, a smaller, rules-based reduction can keep you in the trade.

Calendar centered at support

- Thesis: Price stabilizes near a level, IV increases in your back month.

- Plan: Debit 3.00. Stop at 2.20 debit loss or if price moves outside the calendar tent by more than 1 ATR and does not revert by session close. Avoid holding through a known event that could crush near-term IV if that invalidates the idea.

Covered call with dividend

- Thesis: Generate income while holding stock you want to keep.

- Plan: Use a stock-based stop on the downside. If an ex-dividend date approaches and your short call is in the money, decide whether to accept assignment or roll prior to ex-div.

- Reference: The Options Industry Council provides primers on early exercise and assignment risk that are worth reviewing on optionseducation.org.

Build a stop plan you can automate

- Define the thesis in one sentence, including the catalyst and time window.

- Choose a primary stop type that matches the thesis, for example underlying price for directional trades or debit-based for calendars.

- Add a secondary time stop to avoid theta bleed or event risk.

- Size the trade so that a typical stop does not exceed your per-trade risk budget.

- Specify order mechanics, for example stop limit with a tolerance and the price side to monitor.

- Decide in advance whether you will adjust or exit. Adjustments without rules often enlarge risk.

- Paper test the rules, then automate with rules-based triggers to remove hesitation.

With NeonChainX, you can codify this plan into rule-based triggers and one-click TP or SL automation, then monitor live risk and real-time P and L in one view. If you are new to the platform, the Getting Started guide shows how to connect to Interactive Brokers and place your first paper trade.

Common mistakes that sabotage stops

- Using market stops on illiquid contracts, which can result in poor fills.

- Setting stops at obvious technical levels with no buffer, which invites false triggers.

- Ignoring dividends and early assignment risk on short calls in single stock options.

- Allowing a losing short premium position to grow without a plan because the credit felt small on entry.

- Failing to account for trading hours, so a stop rests overnight and opens deep in the hole on a gap.

Practical order selection and monitoring

- If you need certainty of trigger on a sell to close, monitor the bid and convert to a sell limit with a small tolerance instead of a market order. For buy to close, monitor the ask.

- Use mid-based logic when liquidity is healthy to reduce false triggers, and widen the tolerance during high-volatility sessions.

- For spreads, control the position as a package. Breaking a spread during a fast market can expose you to naked risk and poor re-entry prices.

NeonChainX offers instant multi-chain view and visual spread clarity so you can see the entire position risk, not just one leg. Low-latency execution and direct IBKR integration help reduce the gap between trigger and fill.

A short checklist before you place the trade

- Thesis and time window written down.

- Primary and secondary stop types chosen, with numbers.

- Order mechanics defined, including price side and tolerance.

- Size aligned to risk budget at the stop.

- Event and dividend calendar checked.

- Adjustment rules, if any, defined in one sentence.

Final word

Stop loss strategies for options traders work best when they are matched to position structure, volatility regime, and the thesis you are expressing. Keep your rules simple, codify them, and let automation enforce discipline. If you are ready to operationalize your plan, NeonChainX gives you one-click TP or SL automation, rule-based order triggers, live risk tracking, and a fast, clean interface built for execution. Learn more at NeonChainX and deepen your configuration with the in-depth guide to TP and SL settings.